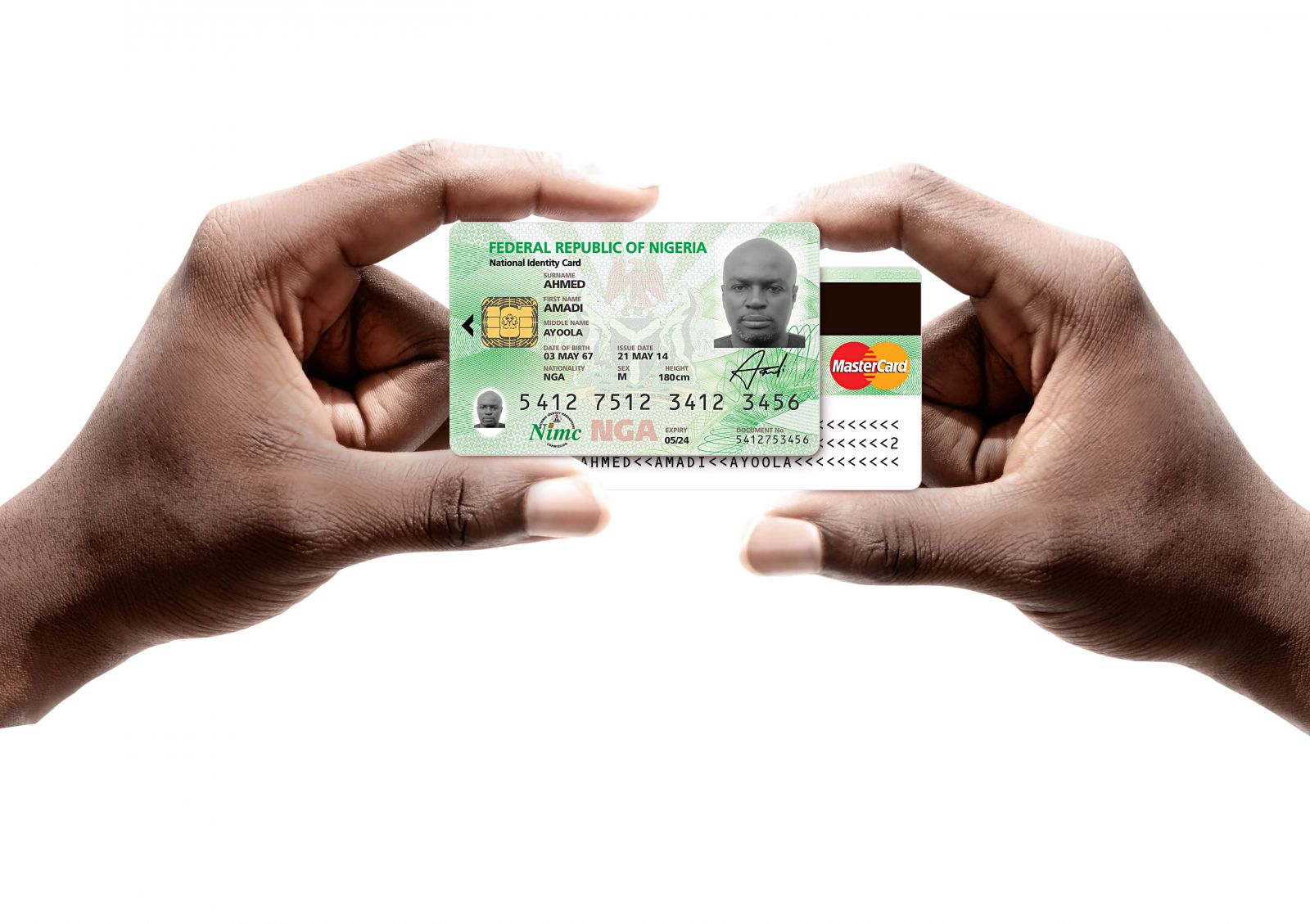

President Goodluck Jonathan on Thursday, August 28, 2014 launched the MasterCard-branded identity cards with electronic payments functionality.

While speaking at a celebratory party in Abuja, the President commended the efforts of Nigerian Identity Management Commission (NIMC), Access bank and other corporate partners for the successful completion of the eID card in Nigeria.

He said, “I am happy that this important milestone of the rollout of the National Identity Management System has been realized today. I am impressed with the quality of the eID card and the work of the corporate partners that made it possible. I commend especially MasterCard, and Access Bank Plc, as well as the Commission [NIMC] for achieving a world-class product.”

President Jonathan's National e-ID card #TheFutureSimplified #AssuredIdentity #GlobalAccess #Multipleapplication pic.twitter.com/cpDv1EIz16

— Reuben Abati (@abati1990) August 28, 2014

He further added that the card will create a platform to a social security benefit system and therefore every Nigerian should endeavor to get the card.

Meanwhile, the Nigerian Identity Management Commission (NIMC) will issue the eID cards to 13 million Nigerians.

This program is considered the largest development of a biometric-based verification card with an electronic payment solution in the country and also the biggest financial inclusion program in Africa.

The eID card which serves as part of the NIMC mandate to create, maintain and operate the country’s first central National Identity Database in providing proof of identity to Nigerians 16 years and above will form a key component of the Identity Management System in Nigeria.

With outstanding features such as prepaid payment technology, Cryptovision’s biometric identification technology and 13 applications the card will not only provide Nigerians easy access into banking products, but will also create a well secured, convenience and reliability of electronic transactions.

Also speaking at the event, Bar. Chris ‘E Onyemenam, Director General and CEO of NIMC said the eID program bridge a communication gap between Nigerians and government agencies in electronic transactions.

“The National eID program enables us to create an optimized common platform for Nigerian citizens to easily interact with the various government agencies and to transact electronically,” he said.

“There are many use cases for the card, including the potential to use it as an international travel document, which will have significant implications for border control in Nigeria and West Africa.”

“In close collaboration with both the public and private sectors to achieve the full potential of this program, NIMC is focused on inclusive citizenship, more effective governance, and the creation of a cashless economy, all of which will stimulate economic growth, investment and trade,” he added.

NIMC is working with several government agencies to integrate and harmonize all identity databases including the Driver’s License, Voter Registration, Health Insurance, Tax, SIM and the National Pension Commission (PENCOM) into a single, shared services platform.

Through the collaborative efforts of NIMC (the project lead), MasterCard (payments technology provider), Unified Payment Services Limited (payments processor), Cryptovision (Public Key Infrastructure and Trust Services Provider), and pilot issuing banks including Access Bank Plc, 13 million Nigerians will gain access to state-of-art financial services as part of the pilot program.

“This is a memorable occasion for MasterCard as we witness the start of a financial inclusion program that is unprecedented in scale and scope,” says Daniel Monehin, Division President of Sub-Saharan Africa, MasterCard. “Combining an identity card with MasterCard’s prepaid payment capability creates a game changer as it breaks down one of the most significant barriers to financial inclusion – proof of identity – while simultaneously enabling Nigerians to access the global economy.”

The importance of using eID card as a payment tool cannot be overlooked as Nigerians can now deposit cash, receive social benefits,save, or engage in many other financial transactions that are facilitated by electronic payments with the extra security assurance that biometric verification provides.

Used in more than 210 countries, Nigerians can also pay for goods and services and withdraw cash at millions of merchants and ATMS that accept MasterCard payment cards.

The card also comes with safety and security benefits offered by the EMV Chip and Pin standard.

Group Managing Director, Access Bank Plc Herbert Wigwe, said: “Access Bank is a supporter and promoter of innovative ideas that would improve the quality of lives of Nigerians. This initiative provides another opportunity to highlight our commitment to national development and nation building.”

Nigerians from 16 years and above are hereby advised to visit the NIMC enrollment centers nationwide to get their eID cards. The process which involves the recording of each individual’s demographic data and biometric data (capture of 10 fingerprints, facial picture and Iris) to authenticate the cardholder and ensure that there are no duplicates on the system.

After the registration, NIMC will issue the individual with a unique National Identification Number (NIN), followed by the national eID card.

“By supporting the Nigerian Government in the implementation of a world-class and innovative electronic payments program, we are helping them to reduce the costs of cash to the economy and society, improve efficiencies and prevent fraud and corruption. More importantly, we are opening up a world of financial inclusion to millions of Nigerians and improving lives,” says Monehin.