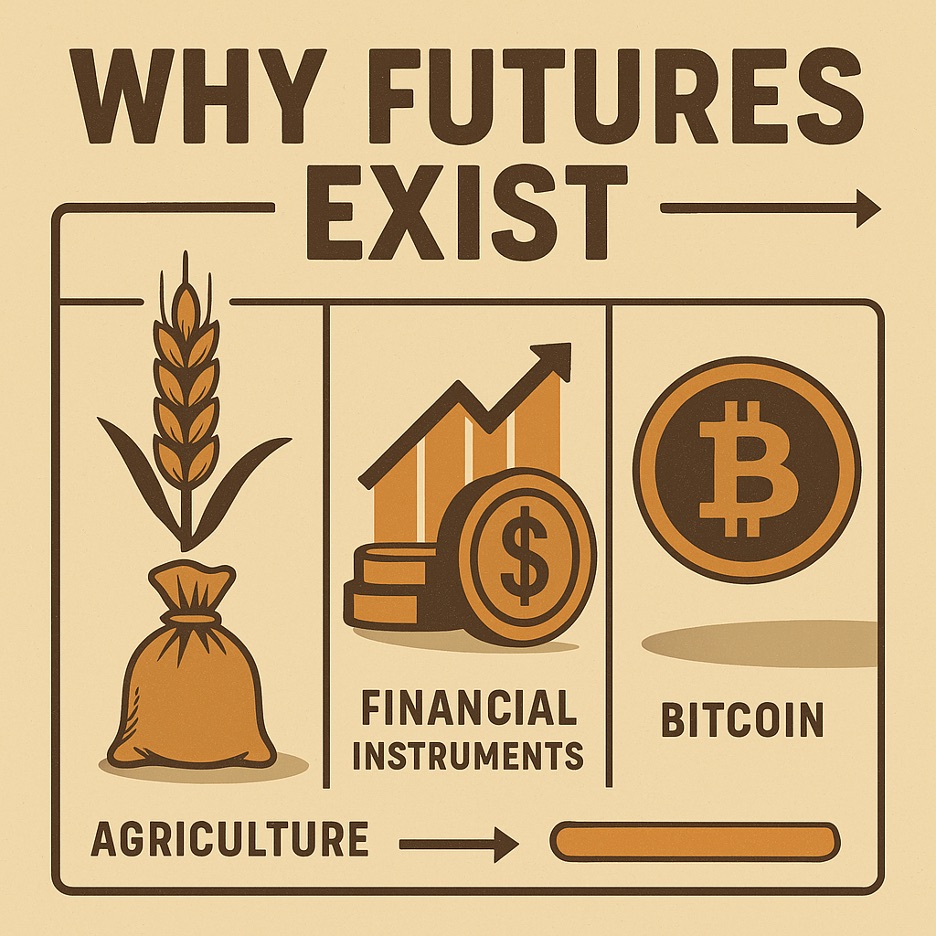

Have you ever thought about why farmers can sleep easier knowing their crop prices are locked in months ahead? Or how traders bet on Bitcoin without owning any coins? That’s the world of futures contracts. These agreements to buy or sell an asset at a set price on a future date have been around for centuries, evolving from simple hedges to complex financial tools.

Futures started in the 1800s to tame market chaos. Today, they’re essential in everything from grains to digital currencies. The global futures market saw nearly 10 billion contracts traded in the first four months of 2025 alone. That’s a 12% jump from last year.

As a trader with years in crypto and traditional markets, I’ve used futures to manage risks and spot opportunities. They stabilize economies by letting people hedge against price swings. This article traces their journey from farms to Bitcoin, showing why they matter now more than ever.

Origins of Futures in Agriculture

Futures began on the dusty floors of Chicago in the mid-1800s. Farmers faced wild price swings due to weather, harvests, and demand. The Chicago Board of Trade (CBOT), founded in 1848, created the first futures contracts for grains like wheat and corn.

These contracts let farmers sell their future harvest at a fixed price today. Buyers, like millers, locked in supplies without fearing shortages. It was a win-win, reducing uncertainty.

By the 1870s, standardized contracts made trading easier. Volume exploded as more commodities joined, like livestock and cotton.

In my macro analysis, I’ve seen how these tools protect against inflation or droughts. Today, agricultural futures handle massive volumes. CME Group’s ag products see strong activity, with corn futures alone drawing billions in notional value yearly.

But it’s not just history. In 2025, with climate change hitting crops, futures are vital. They help global food chains stay steady.

Challenges persist, like basis risk where contract prices don’t match local ones. Yet, electronic trading has boosted accessibility.

Here’s a comparison of old and new agriculture futures:

| Aspect | Traditional Futures | Modern Futures |

| Access | Farmers/brokers | Global platforms |

| Instruments | Grain, livestock | + Indices, ETFs |

| Trading Speed | Days | Seconds |

| Transparency | Limited | Full electronic |

| Volume | Local markets | Billions of dollars |

This evolution shows futures’ core purpose: risk management.

Futures in Traditional Finance and Commodity Markets

Futures expanded beyond farms into finance and commodities in the 20th century. Oil, metals, and stock indices became staples. Think of the 1970s oil crisis; futures let companies hedge against price spikes.

Airlines use jet fuel futures to cap costs. Miners lock in gold prices. The CME Group, merging CBOT and others, now averages 30 million contracts daily in 2025. That’s up 16% from last year.

These tools serve two crowds: hedgers and speculators. Hedgers protect real assets; speculators bet on directions for profit.

I’ve traded commodity futures during booms. They correlate with global events, like wars boosting oil contracts.

Financial futures, like S&P 500 ones, let investors hedge portfolios. They’re liquid, with tight spreads.

Micro-futures make it accessible for small traders. A micro E-mini S&P costs a fraction of the full contract.

Regulations from bodies like the CFTC keep markets fair. But leverage amplifies losses, so education is key.

In commodities, futures influence spot prices through convergence. They provide price discovery for the world.

Overall, these markets stabilize economies. Without them, volatility would skyrocket.

Futures in Cryptocurrencies and Bitcoin

Crypto brought futures into the digital age. Bitcoin futures launched on CME in 2017, letting institutions trade without holding coins. It was a bridge to traditional finance.

Crypto futures trading exploded, with daily derivatives volume hitting $24.6 billion on average in 2025. That’s up 16% year-over-year.

Platforms like Binance saw $2.55 trillion in futures volume just in July. Perpetual contracts, without expiry, dominate.

Miners hedge Bitcoin production. Traders use leverage up to 100x, amplifying gains or losses.

I’ve navigated crypto futures during bull runs. They offer shorting options, profiting from drops.

Ethereum futures followed, tying into DeFi. Micro Bitcoin futures lower entry barriers.

Regulation grows, with SEC oversight. It adds legitimacy but curbs wild leverage.

Open interest in Bitcoin futures reflects market sentiment. High levels signal strong participation.

Crypto futures stabilize prices by attracting big money. ETFs built on them boosted adoption.

Yet, 24/7 trading demands vigilance. Volatility remains, but futures tame it somewhat.

In Conclusion

Futures exist to manage uncertainty, from ancient grain deals to modern crypto bets. They started in agriculture for stability, spread to commodities and finance for hedging, and now thrive in Bitcoin for innovation.

In 2025, with global tensions and tech shifts, futures are indispensable. Volumes hit records, like CME’s 35.9 million daily in April. Crypto derivatives top trillions monthly.

But they’re tools, not magic. Leverage requires caution; education prevents pitfalls.

As a trader, I see futures evolving with tokenization and AI. By 2030, they might cover more assets, like carbon credits or NFTs.

For anyone in business or investing, learn futures. Start small, understand mechanics. They could safeguard your future in unpredictable times. After all, in markets, preparation beats prediction.

![Honouring a Rare Soul: Celebrating the Life of AVM Terry Omatsola Okorodudu [MUST READ] Air Vice Marshal Terry Omatsola Okorodudu](https://www.thetrentonline.com/wp-content/uploads/2026/01/Joan-and-Bidemi-Okorodudu-The-Trent-100x70.jpg)