The Unity Bank Plc on Thursday, August 13, 2020, said the $2, 267,400 it received from a former Attorney General of the Federation, AGF, and Minister of Justice, Bello Adoke, was not proceeds of crime but for the repayment of a N300 million loan he obtained from the bank.

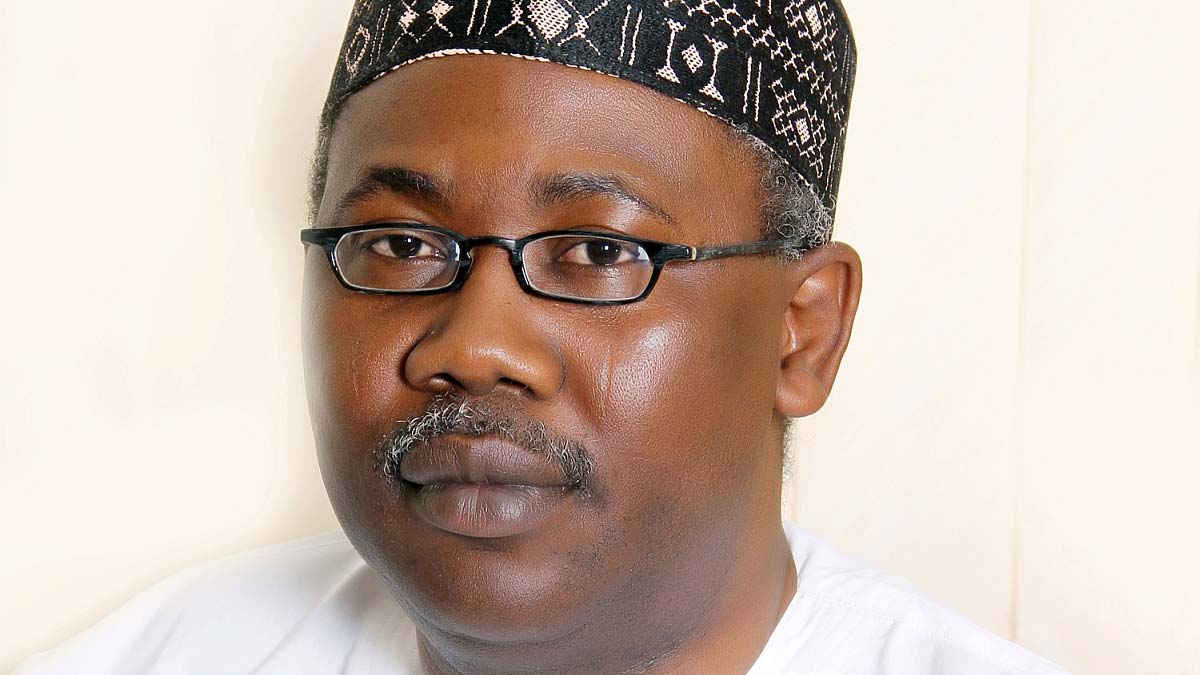

Rislanudeen Mohammed, a former acting Managing Director, MD, of the bank, stated this at the Federal High Court in Abuja during the ongoing trial of Mr Adoke and a businessman, Aliyu Abubakar, on corruption charges.

The Economic and Financial Crimes Commission, EFCC, had on August 4 re-arraigned Messrs Adoke and Abubakar on an amended 14-count charge bordering on money laundering.

They face a seven-count charge each but both pleaded not guilty to the charges.

In count nine of the charge, the anti-graft agency accused Mr Adoke of making a cash payment of $2,267,400 to Mr Muhammed in September 2013 in Abuja.

An offence contrary to the combined effect of section 16 (1) () and of section 1(a) of the Money Laundering Prohibition Act 2011 (as amended) and punishable under section 16 (2)(b) of the same Act

Messrs Adoke and Abubakar are also standing trial alongside others at the FCT High Court in Gwagwalada in Abuja, in respect of the Malabu oil transaction.

Testimony

On Thursday, while giving his evidence in chief (as the second prosecution witness) led by the EFCC lawyer, Bala Sanga, the former bank MD said he has been friends with Mr Adoke since 1990.

Muhammed said sometime in 2012, the former AGF requested a loan of N300 million from Unity bank.

Due to incomplete documentation for the account, the witness said a temporary overdraft facility was initiated and the loan was approved.

Muhammed said he later approached Mr Adoke after the branch manager of the Bank informed him that a fee of N6 million had not been paid.

He said the former AGF sent the N6 million through his driver and it was handed over to the branch manager.

Testifying further, the witness said the Central Bank of Nigeria, CBN, and the Nigeria Deposit Insurance Corporation, NDIC, came to the bank to carry out a risk management assessment, and the bank was queried for having a plethora of nonperforming loans.

He said due to the good relationship he had with the first defendant, he started to mount pressure on him to repay the loan in order to avoid his name being published as part of defaulters having nonperforming loans.

According to the witness, Mr Adoke later invited him to his residence and gave him a cash sum of $2,267,400.

“He called me to his house and he gave me the money in a black bag. It was taken from the boot of his car into the boot of my car,” he said.

Muhammed said the $2,267,400 was converted to naira and the bank deducted the loaned sum alongside the accrued interest, leaving a residual balance of N3,800,000.

He said Mr Adoke later “wrote to the bank requesting for a cash payment of N3,500,000 through his driver.”

The witness said when the account was closed, a residual balance of about N223,000 was issued to Adoke by way of manager’s cheque.

When asked if the former AGF had a dollar account with Unity Bank, the witness said he was not aware.

“Even if he had, the amount is above the specified threshold. Because of money laundering issues, there was no way that amount of money would reflect into his account,” Mr Mohammed said.

Cross-Examination

Under cross-examination by Mr Adoke’s lawyer, Kanu Agabi, the witness was asked if the money ($2,267,400) was available to be confiscated.

The witness answered in the negative, saying it was not available because it was not a proceed of crime.

“I have no reason to believe that it was a proceed of crime,” he said.

“Is the sum available in the account of the first defendant?” Mr Agabi asked and Mr Muhammed replied; “No, the money is not there.”

Meanwhile, the first prosecution witness, a manager in charge of foreign exchange trade at the CBN, Clement Osagie, tendered foreign exchange transaction rates covering August, September, and October 2013 and were admitted as exhibits.

Under cross-examination by the second defendant’s lawyer, Olalekan Ojo, the witness who stated that the documents tendered were generated from the electronic system of the CBN, said he was not among the personnel of the Information Technology, IT, department of the CBN.

Answering a question, Mr Osagie said that the CBN’s licenced Bureau de Change, BDC, operators file reports of transactions in CBN forex which are kept by the Trade and Exchange department but he cannot talk on the activities of the BDC.

While admitting that he does not know the defendants in the case, Mr Osagie disclosed that his statement to the anti-graft agency was made after the last court’s proceedings.

Osagie added that “I thought I would just come and tender the documents before the court and go.”

The case has been adjourned to September 7 for the continuation of trial.

At the end of the proceedings, Justice Inyang Ekwo noted that the case before the court has nothing to do with the controversial Malabu oil transaction.

He warned litigants and journalists to desist from giving conflicting reports.

Source: Premium Times