The Central Bank of Nigeria (CBN) has said that the recent restriction placed on the use of bank cards abroad will remain until the country’s foreign reserves grow to significant levels.

Commercial banks in the country reversed one of the major gains of the consolidation era when they sent text messages to their customers last week informing them that they would no longer be allowed to use their naira-denominated debit and credit MasterCard to pay for transactions or withdraw money from ATMs overseas.

The ban, which has the backing of the CBN, stemmed from dwindling foreign reserves and banks’ inability to settle dollar transactions arising from the use of naira cards abroad.

Since oil prices fell, Nigeria has witnessed a precipitous decline in forex earnings and by extension foreign reserves, forcing the CBN to impose foreign currency curbs aimed at preserving the country’s reserves.

Speaking with journalists at the weekend, CBN’s Director, Monetary Policy, Mr. Moses Tule, said restrictions were likely to be lifted when reserves increase to between $50 billion and $200 billion, adding that all hands must be on deck to achieve the target.

He said the new policy was a healthy development for the ailing economy in spite of the attendant inconvenience to cardholders.

“It is healthy development; Nigerians can no longer use debit cards abroad. But we know that it is inconvenient. Right now the country is going through very difficult times because of developments in the oil market. Foreign exchange under the condition Nigeria has found itself has become a seasonal commodity.

“Seasonal in the sense that it depends on the movement of the price of oil; if oil prices are high then we build reserves, if oil prices are low then we have no reserves then we are in a crisis.

“That should not be the case for an economy as big as that of Nigeria because we should by now have sufficiently diversified the economy to a point where developments in the oil market should no longer matter.

“Unfortunately, that has not been the case and that is why sometimes these kind of decisions have to be made,” he said.

However, he said the restrictions were largely the decision of the banks rather than the CBN.

According to Tule, “The restriction on the use of debit and credit cards outside the country was not imposed by the CBN. The deposit money banks (DMBs) placed it because they have to settle whatever transactions you make with your cards with their corresponding banks in foreign currency and if the banks do not have the foreign currency to do that, then you create a liability which will crystallise on their balance sheets.”

He added: “But looking at it holistically, does the CBN sympathise with the situation Nigerians find themselves in not being able to use their cards outside the country, yes the CBN certainly does sympathise with the hardship Nigerians are facing.

“But can the CBN stop it, at the point we are in in this country, the obvious answer is that the CBN cannot stop what the banks are doing now and the reason is very obvious.

“Our priorities as a nation for the allocation or use of foreign exchange is one, for the settlement of matured letters of credit that have been opened for importation; two, for the importation of petroleum products until such a time either when we have our refineries fully operational and we are not in a position to import fuel again to ensure that the wheels of economic development continue turning and running; and three, for the importation of raw materials.

“Now, by the time we meet these given the level of current flows into the reserves – by the time we meet these three priority areas – you will discover that people who are using their debit cards overseas for shopping can never be on the priority list.

“We would then go back to the point where the foreign reserves dry up that is the position we are in today.”

On whether the CBN was considering stopping the sale of dollars to bureau de change (BDC) operators, he said: “If you read the budget speech of Mr. President, there was one sentence there where he said we must make hard choices.

“That is designed to open the growth potential of the economy and the president has said we must make hard choices. As policy makers, we are going to make those hard choices, so at the right time, the CBN will take the appropriate decision that will strengthen the foreign exchange market.”

On the push for devaluation of the naira, he said: “No matter how good a professor of war studies is, he cannot tell a general how to conduct and deploy his men.

“The general is the man on the field, he is where the battle is, he has his maps and strategy for the battle that will give him victory no matter how knowledgeable the professor is he cannot advise him in the battlefront.

“People should respect institutions, so if you have some advice to give, you can always write to the CBN governor.

“But no central bank takes decisions just because analysts either in newspapers or on television recommend that the naira should be devalued today, as policy makers have to weigh the fundamentals.

“However, the CBN is holistically looking at the issues, and as we have consistently said, we will not hesitate to take the right decision that in our opinion is in the best interest of the country and help realise the goals of government as enunciated in the 2016 budget.

“So overall that is the position of the CBN; there is a policy direction which government has given in the 2016 budget and every central bank works with the policy direction of government and we will not work outside that framework.”

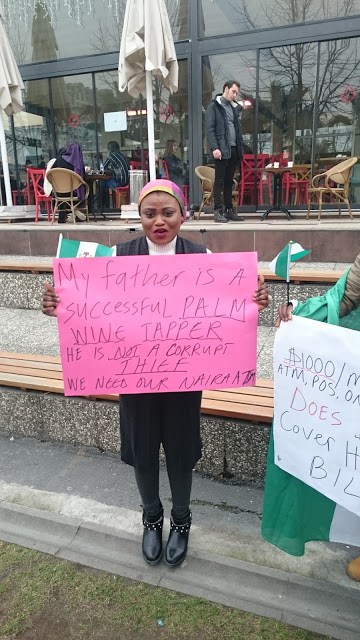

Despite the explanation given by the CBN, the ban on the use of naira-denominated bank cards has not gone down well with Nigerian students in the United Kingdom, who at the weekend took to the streets to protest the ban.

Armed with placards, the protesters expressed their anger.

A lady who held a Nigerian flag displayed a placard that read: “My father is a successful palm wine tapper. He is not a corrupt thief. We need our naira ATM (card).”

Another placard read: “CBN Governor, why? Can you not advise Buhari? We need our naira ATM cards to survive.”

Another held a placard which also read: “My father is not a politician or government thief. He is only a businessman. I need my naira ATM (card).”

Nigerians in the Diaspora also protested against the spending limits imposed on their dollar-denominated debit and credit cards, reported online website, African Spotlight.

In a group photo, a lady said: “Nigerian students abroad need their naira MasterCard to survive,” while a man who wrapped himself with Nigerian flag wrote on his placard, “$1000/month on ATM/POS/online does not cover hospital bills.