The Central Bank of Nigeria (CBN) Tuesday, July 22, 2014 resolved to leave the monetary policy rate (MPR), otherwise known as interest rate unchanged at 12 per cent with a corridor of +/- 200 basis points.

It also retained the cash reserve requirement (CRR) of both public and private sector deposits at 75 per cent and 15 per cent respectively while the liquidity ratio was left at 30 percent cent.

The MPR is the rate at which the CBN lends to commercial banks and usually determines the cost of funds while the CRR is a restrictive monetary policy tool used by the apex bank to determine the volume of liquidity in banks’ vault.

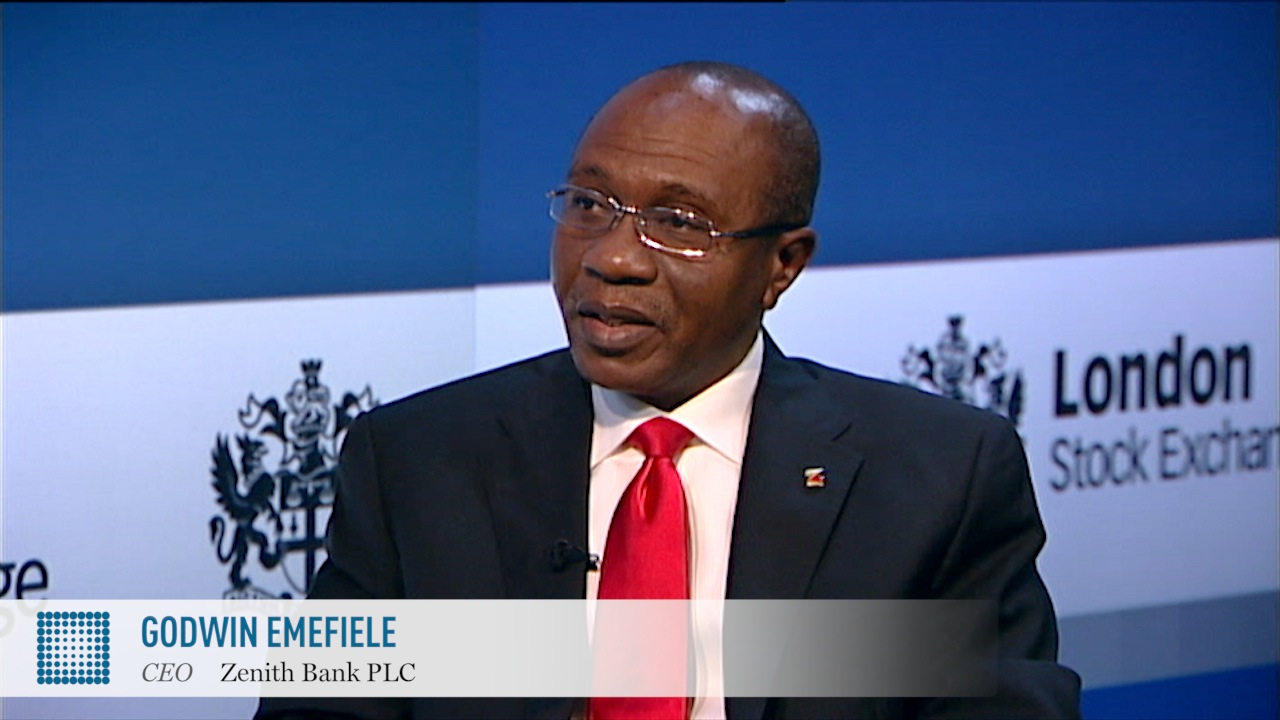

Addressing journalists in Abuja after the two-day meeting of the Monetary Policy Committee (MPC), CBN Governor, Mr. Godwin Emefiele, also restated his commitment to gradually reduce interest rate but appealed for patience in order to have the appropriate macroeconomic conditions needed to implement the rates cut-a promise he made on assuming office in June.

He said he was optimistic about achieving low interest rates within a five- year plan taking into considering all variables within the ambit of the monetary parameters.

It also emerged that the country’s gross foreign reserves had increased to about $40.20 billion as at July 18 compared to about $37.31 billion at end-June 2014 following increased accretion and moderation in the rate of depletion.

The CBN boss said the current level of reserves could comfortably support about 10 months of imports.

Emefiele who read the communique issued at the end of the meeting said the committee unanimously decided to hold rates at current levels having been satisfied with the relative stability in the macroeconomic landscape which had shown impressive growth rates, stable consumer prices and exchange rate as well as increased external reserves.

The committee, however, raised concerns over current liquidity levels in relation with the possibility of increased government spending in the run up to the 2015 elections-on the one hand- and the trending uptick in inflation which may not be unconnected with the poor harvest in some agricultural producing areas, particularly in the north eastern and central states of the country.

It equally expressed worry that portfolio flows were not employment generating though essential in the absence of adequate fiscal buffers.

While noting that the policy direction for inflation, exchange rate and interest rate must be seen not only in the context of price and financial stability but also in enhancing the quality of life of Nigerians and promoting employment generation, it added that other reform measures could dampen food prices in the short to medium term and restore inflation to a sustainable long-run path.

He said: “The Committee noted the potential of the power sector to stimulate output growth through enhanced investment and the spill-over effect in employment generation if the challenges confronting the sector are effectively and appropriately addressed. Specifically, it noted that gas-to-power has remained a binding constraint in reaping the benefits of the recently-concluded power sector reforms; urging for the collective efforts of government, private investors and the banks to resolve. Other pressure points include the underlying pressure from food/core inflation and the risks that could emanate from the likely increase in aggregate spending in the run up to the 2015 general elections.”

According to him:”The Committee was also concerned about the implications of the on-going QE3 tapering for inflows and external reserves. The Committee recognized the necessity of sustaining a stable naira exchange even as it has to deal with the delicate balancing of the need for a low interest rate regime. The Committee noted that portfolio flows were not employment generating but were essential in the absence of adequate fiscal buffers. The Committee welcomed the moderation in the rate of depletion in external reserves in recent months, noting that reserves accretion needed to improve much faster to provide a strong and more resilient buffer to fiscal operations. The Committee, however, noted that a gradual reduction in the country’s import bills through domestic production of some of the major food imports should be a key element in the overall reserves accretion strategy. It welcomed the decision of the Bank to collaborate with other stakeholders in this regard.”