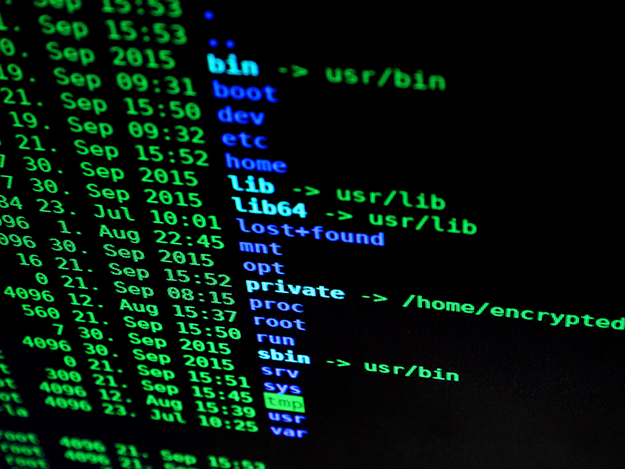

[dropcap]W[/dropcap]ith the upswing on mobile technology and computer systems overall, hackers are finding their niche for making a hobby of dubious ethical values a mean for living with certain comfort if we take into account recent news on how many payment entities were subject to digital attacks to date.

There is, undoubtedly, a need for keep investing time and resources for crafting secure authentication methods when we talk about services like PayPal, online casinos, electronic banking, or even banking entities overall at the moment of performing operations like major withdrawals. So, is a strong password the answer for fixing potential security liabilities? Most certainly, no.

Old reliable passwords vs. Trending Technology

There is a common misconception in believing your mail or other accounts/services under your name are safe just because you didn’t divulge your password. Hackers start by learning how to crack passwords as their baby steps for entering this “profession”. If, as a hacker, you cannot access an account whose password only counts with 6 characters without distinctions between capital letters and lowercase ones, or without alphanumeric combination, then probably it’s time to start thinking of another career.

One of the most common mistakes is using the very same password for your social media accounts, emails, banking data, and so on. Security experts advise us to, at least, follow these very steps in the process of creating passwords:

- Include numbers, symbols and capital letters

- Avoid dictionary words

- Change your passwords once per 180 days

However, there are certain inconveniences related to having multiple passwords, which could be resumed in the possibility of losing your smartphone. Most people have the tendency of storing their passwords as a way of preventing password-loss situations, causing at the same time a dependency on the mobile device itself. By losing your phone, you are also losing access to your data, given whoever found it a free pass to your conversations, mail exchanges and, when acting neglectfully, access to your banking accounts stored in the device’s web browser.

Photo courtesy of Startup Stock Photos

Two-step authentication is a must-have resource for any serious login data interface. Why? Simple as this: in case someone guessed or cracked your password, another authentication stage is required that only you can perform. This can be either a pin sent to your smartphone, a geo-tagged login or many other possibilities we can imagine these days.

What Biometrics can give to banking entities

Banking entities have incurred in the usage of two-step authentication methods for a long while by now. Clear proofs of such security means are the usage of digital keys in combination with strong passwords with an expiration date or asking for personal data plus a PIN when seeking phone attention – but what if technology can sum up to this process?

Biometrics are known to be metrics related to human biological characteristics. Therefore identification methods using this data prove, at least to date, to be the most effective means for securing a user’s account given the fact they cannot be faked. Sci-fi movies were true visionaries in what regards to the usage of biometrics for security access, even predicting technologies with a span of over 50 years as what is the case of movies like Star Trek (1966) when using face recognition scanners for accessing archive databases.

Infographic Courtesy of Avatier

Many banks worldwide are adapting their login interface to meet up with iPhone’s TouchID technology as a way to speed up login process while, at the same time, increasing security measures. Citibank also innovated by introducing voice biometrics through their CitiPhone system.

However, there’s still a plenty road to walk in what regards to putting technology to the services of customers. Smartphones like the Samsung Galaxy Note 7 are taking security methods to the next level by including iris scanner features without making the whole process a tiresome ordeal for syncing our login interfaces – yet some corporations are reticent to adapt their authentication methods to meet up with these advancements. Either negligence or low-budget policies for investing in new technology can be labelled as the leading causes for such a slow-paced change in security authentications methods. Only time would tell how costly is going to be to be held back in time in contrast to those who decided to put their bets in tomorrow’s technology methods.

Vikas Agrawal is a start-up Investor & co-founder of the Infographic design agency Infobrandz that offers creative and premium visual content solutions to medium to large companies. Content created by Infobrandz are loved, shared & can be found all over the internet on high authority platforms like HuffingtonPost, Businessinsider, Forbes , Tech.co & EliteDaily.

Vikas Agrawal is a start-up Investor & co-founder of the Infographic design agency Infobrandz that offers creative and premium visual content solutions to medium to large companies. Content created by Infobrandz are loved, shared & can be found all over the internet on high authority platforms like HuffingtonPost, Businessinsider, Forbes , Tech.co & EliteDaily.