[dropcap]T[/dropcap]rends are defined by a strong motive action in price.

In such markets, price tends to maintain the momentum and the prevailing trend. Trading the trending FX markets is of course widely preferred over other methods such as range forex trading or breakout forex trading.

Depending on the type of asset class you are looking at, the trends may vary. Generally, trends are more pronounced in commodities.

One of the reasons behind this is the asset class itself. For example, natural gas, grains and so on depend on seasonality.

There are times when there is an increased demand for commodities and times when demand falls.

Depending on the seasonal factors, trends are clearly established. In the forex markets, one can also find currency pair trends that tend to span a considerable period of time, depending on economic and other factors.

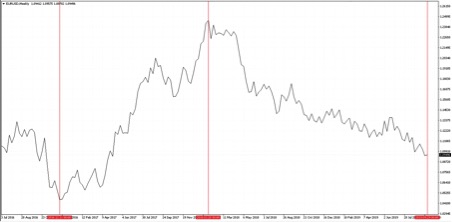

For example, the EURUSD was in a clear uptrend for the periods of December 2016 through late January 2018.

Likewise, the currency pair has been in a descent since January 2018. When such trends are established, forex traders can take advantage of the momentum and position themselves on the right side of the market.

EURUSD Trends

Ways to Use Technical Analysis to Trade Trends

As an FX trader, you can trade the markets using different methods of technical analysis.

Here are some useful methods of trading trending markets using technical analysis.

1. The HiLo Method

Trends, as you know, tend to correct themselves. This can lead to different segments of trends. For example, the monthly trend might be up, but a 4-hour chart can show a downtrend. This is nothing but a correction to the major uptrend.

The HiLo method can tell forex traders when a trend could end on a specific timeframe, or at least when a trend could weaken to a correction level. For example, when a recent price level is penetrated downwards on the 4-hour chart, this can be an indication of uptrend exhaustion. The end of the trend would be validated only if the daily chart signaled an identical pattern.

Using the HiLo method, FX traders are able to identify potential levels where prices are likely to correct to or reverse from and continue with the major trend.

This is nothing but trading swing highs and swing lows that move along with the trend.

With the HiLo (High Low) method, forex traders usually keep an eye on the second swing high or low, as usually the first gives in to take-profit pressures.

2. Using Trend Lines

Using price action methods such as trend lines, traders can anticipate the potential test of the trend line. Of course, price might not always respect the trend line, but it gives an estimate of the price levels to which a security may fall.

Using trend lines, one can also chart potential swing highs and lows. Or vice versa.

Draw trendlines by connecting two highs or lows with a diagonal line. The breakout or rejection at the trendline can be used to confirm the resumption of the trend or invalidate it.

3. Technical Indicators (Divergence)

While there are many technical indicators one can use, the oscillator divergence is one of the best.

Divergence is when two data sets fail to move in tandem. In trading parlance, when price is making a higher high, the oscillator is also expected to behave similarly.

But when there is a divergence between price and oscillator, it can point to potential corrections in price.

Using divergence as a tool (and possibly combining it with the retracement method), forex traders can anticipate where potential trend corrections could end.

This allows FX traders to find the best turning points in price and help to enter the trend.

What is the Goal of Trend Trading Anyway?

While trend forex trading might seem as simple as trading in the direction of the trend, that is just a blanket term.

The main gold of trend trading is to firstly identify the trend (which has already been established) and to find the turning points in the trend.

This allows FX traders to find the best possible price entry points into riding the trends.

Using one of the different ways outlined, forex traders are able to build their own trading systems for trading the trending markets.