Sixteen states of the federation have raised bonds totalling N520 billion in the last six years without clear outlines on how the funds were used, THISDAY investigation has revealed.

This is against the backdrop of massive unemployment and infrastructural deficit across the country, which the debts could have addressed.

Specifically, the 16 state governments were found to have raised the bonds without their citizens’ understanding of what the funds are meant for.

Filings by the state governments at the Nigerian Stock Exchange (NSE) showed that Kogi state’s N5 billion bond is the smallest so far while Lagos emerged the biggest debtor with a total of N187 billion issued so far.

Analysis of numbers obtained by THISDAY showed that Osun state with internal generated revenue and federal allocation of less than N2 billion has so far raised N30 billion including the just concluded N11.4 billion sukuk.

Others include: Kwara N17 billion, Niger N15 billion, Kaduna N8.5 billion, Gombe N20 billion and Edo N25 billion.

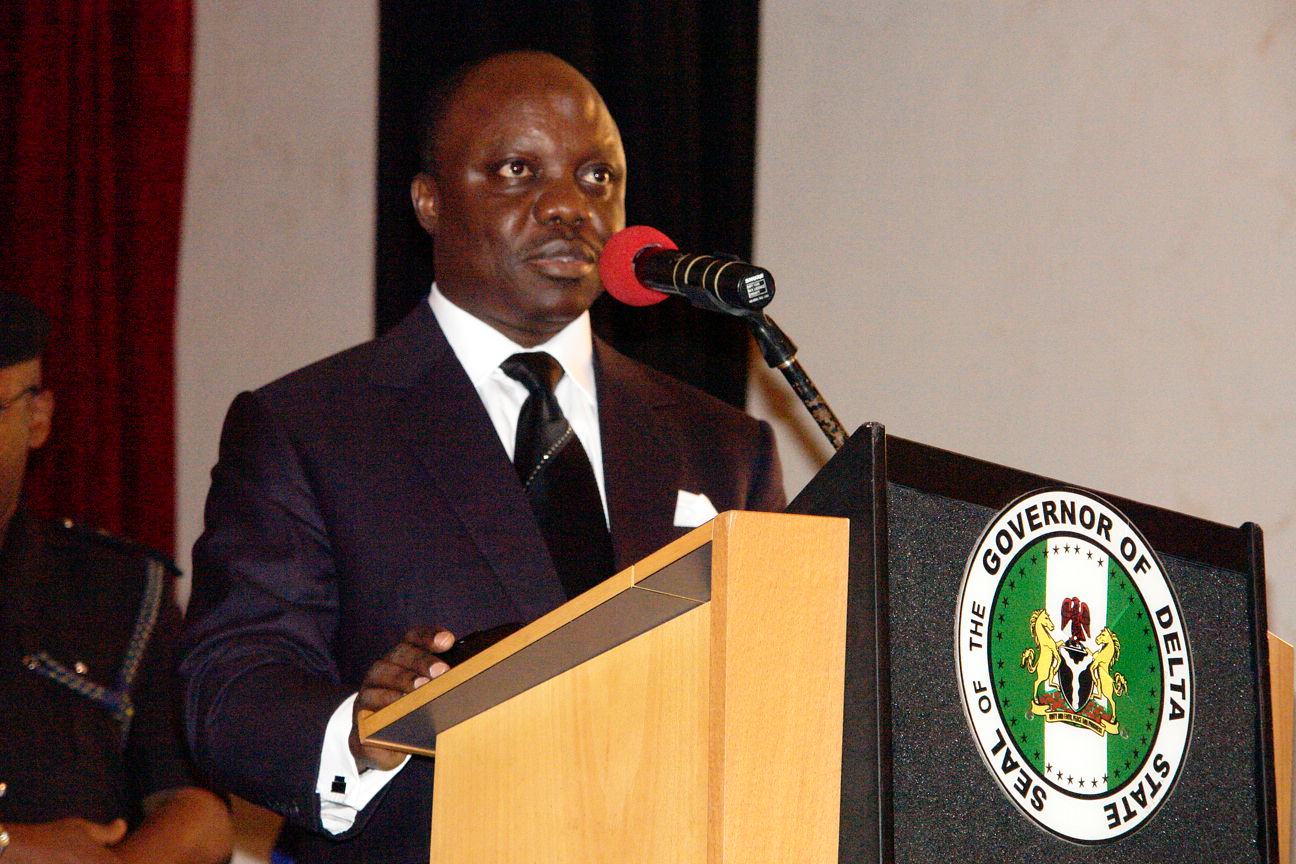

Benue, Ebonyi state Ondo state, Ekiti state, Bayelsa state, Imo state and Delta state have also raised N13 billion, N16.5 billion, N27 billion, N25 billion N50 billion, N18.5 billion and N50 billion respectively.

THISDAY investigation also revealed that Oyo, Ekiti, Zamfara, Rivers and Adamawa states respectively have concluded arrangements to head to the stock market to have a taste of the binge.

THISDAY findings also revealed that the states activities at the bond market have crowded out corporates, particularly the manufacturing sector thus inhibiting their ability to create value and employment.p

Although safety of the funds is paramount, experts believe that pension funds administrators (PFAs) should do more than rely mainly on state and federal government bonds to invest pension contributions.

The PFAs held bonds totalling N1.9 trillion at the end of March, equivalent to 45 per cent of their assets under management and 42 per cent of the outstanding stock of debt instruments.