The Central Bank of Nigeria (CBN) has stated that the nation’s currency which has lost about 30 percent of its value against the United States dollar for about nine months will recover after the presidential election on Saturday, March 28, 2015.

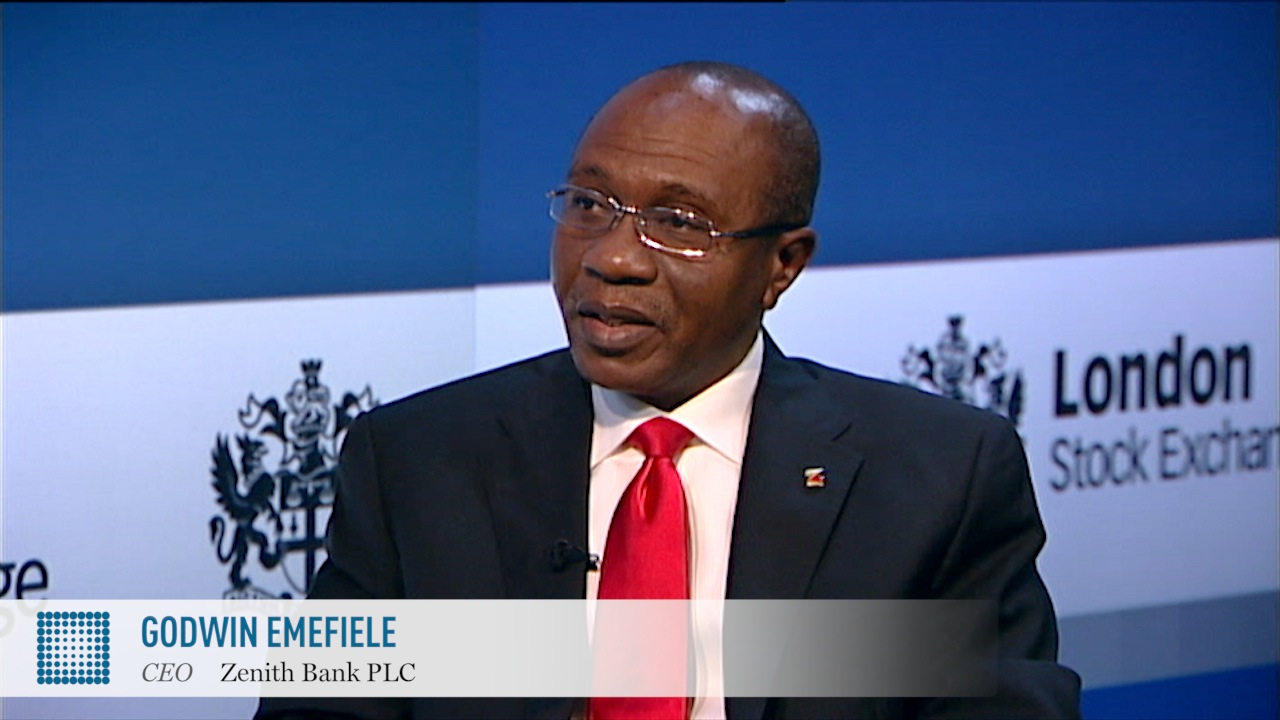

This was disclosed by the governor of the apex bank, Mr. Godwin Emefiele, on Tuesday, March 24, 2015 during a news conference in Abuja at the end of a meeting by the Monetary Policy Committee (MPC).

According to the committee, the devaluation of the Naira would help cut the inflationary effects of high spending before the election.

Emefiele disclosed that the committee is satisfied with the naira, which has come under major pressure since June 2015 due to the collapse in oil prices.

As at Tuesday, March 24, 2015 the Naira exchanged at the interbank market (official window) at N97 per dollar and N225 to a dollar at the parallel market (unofficial market).

“The weakness of the naira has fuelled the illegal use of dollars in day-to- day domestic transactions, such as paying rent or school fees, ” Emefiele said.

“The CBN will, very soon in due course, come after them,” he added. Emefiele said he was worried about the outlook for economic growth, but added that investment and business confidence should pick up after the presidential poll.

“I’m optimistic that after the elections, confidence will improve, businesses will resume. I’m confident the economy will be resilient,” he stated.

The CBN governor’s confidence on the rebound of the naira after election is based on the speculation that the partial dollarisation of the economy is prompted by political activities currently inherent in the nation.

He said the closure of the Retail Dutch Auction System (RDAS) window of the foreign exchange market on February 18, 2015 had unified the foreign exchange market, according to New Telegraph.

As a result, the currency depreciated by N17.90 or 9.04 per cent in the period under review as the exchange rate opened at N180.1 to $1 and closed at N198 to $1.

On the wide margin between the official exchange rate and the black market rate, Emefiele said, “You talked about the fact that exchange rate at the bureau de change segment of the market is N220, N221 to one dollar. I will like to say that that remains a shallow market compared to the interbank market.

“In terms of percentage in the interbank market, I will like to say that it is very insignificant. That market (black market) deals mainly in transactions that are not documented. And for that reason, we will not be looking at the world outlook for the naira by looking at the bureau de change rate.

“But when you look at outlook based on the interbank, which is today an average of N198 like I read in my statement, I believe that given the pressure that we have seen in the market as a result of the drop in crude prices and the pressures that have come with it that adjusting the currency at the level it is now at N198, I will say it is okay and sufficiently appropriate.

“But I think that a number of actions that will be taken going forward will deepen the market and improve supply into the market. We will look at areas where demand pressures can be cut or demand inefficiency and I am sure in due course, the CBN will begin to take actions that will look at areas where people can make demands that will not be effective, demands that are not useful for the economy.”

The governor said with reserves at $30 billion right now, given the pressures and vulnerability of the last couple of weeks, “I think it is a good level of reserve and can support close to about five to six months of import and this is enough to support business and the economy.”

He also warned banks to avoid transacting businesses in dollar or risks sanctions, adding that naira remained the Nigerian currency and should be used for all local transactions.