As if being kicked out of one of the world’s biggest emerging-market bond indexes isn’t enough, Nigeria now faces the risk of its credit rating falling further into junk.

Standard & Poor’s, which rates Africa’s largest oil producer four levels below investment grade at B+ with a stable outlook, releases a review of its assessment on Sept. 18. A week later, it’s the turn of Fitch Ratings, which has Nigeria at BB-, one level above S&P, with a negative outlook.

Those decisions come on the heels of JPMorgan Chase & Co.’s announcement last week that Nigerian debt will be removed from its local-currency emerging-market indexes, tracked by more than $200 billion of funds. Adding to a loss of favor among investors is a delay by President Muhammadu Buhari in naming his cabinet since taking power in May as the continent’s biggest economy grapples to cope with oil prices below $50 a barrel and speculation that the currency will be devalued.

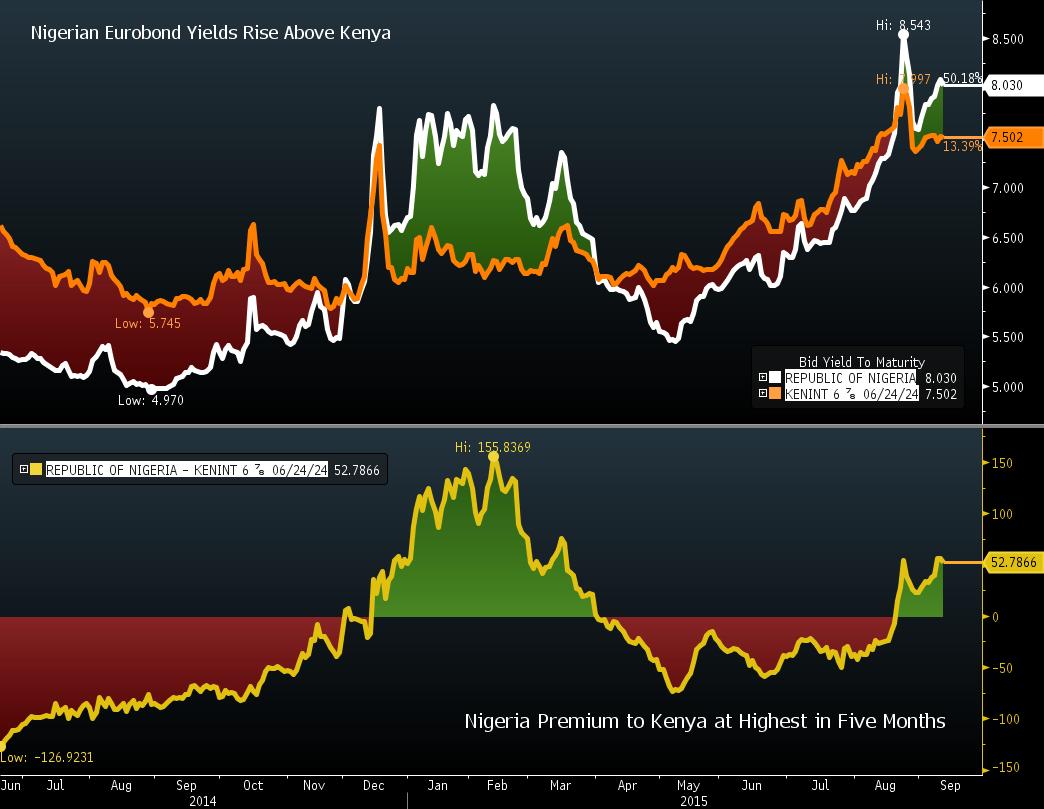

The bond market is siding with Ashmore and Aberdeen Asset Management Plc, which also predicts a ratings cut. Yields on Nigerian dollar bonds have been trading higher than those of Kenya — which has an economy almost a tenth of Nigeria’s size and is rated lower by Fitch — since mid-August. When that last happened in March, S&P downgraded Nigeria and Fitch followed days later by lowering its outlook from stable.

“Fitch is the one people will be watching most closely,” Alan Cameron, an economist at Exotix Partners LLP in London, said by phone on Sept. 10. “The oil price has been low for a long time and people assume that’s at least a semi-permanent state of affairs, which will have a very significant impact on fiscal and external projections. It is difficult to argue that Nigeria should not be downgraded at this point.”

Central Bank of Nigeria Governor Godwin Emefiele has introduced several foreign-exchange restrictions since December to prevent dollars fleeing the economy amid an almost 60 percent drop over the past year in the price of oil, which accounts for 90 percent of exports and two-thirds of government revenue.

Emefiele resorted to the measures as the naira weakened 20 percent to a record of 206.32 per dollar in the year through Feb. 12. While the restrictions helped to stabilize the currency at an average of 198.98 since its all-time low, foreign-exchange trading has dried up, contributing to JPMorgan’s decision to remove Nigeria’s bonds from its benchmark indexes.

“To lose the index status is a classic own goal,” Kevin Daly, a money manager at Aberdeen, who sold all his Nigerian sovereign debt last year, said by phone from London on Sept. 10. “They were trying to convince investors that they should remain in. The problem was that by squeezing the FX market and not allowing any locals to trade it, they just pushed investors to the sidelines. That forced JPMorgan’s hand.”

Fitch could lower Nigeria to B+, while S&P will wait to see Buhari’s cabinet and what economic policies he introduces, said Daly, who prefers Angola and Gabon’s dollar securities because of their higher spreads. Buhari has pledged to name his ministers by the end of September. Calls to Femi Adesina, the president’s spokesman, and Ibrahim Mu’azu, a spokesman for the Abuja-based central bank, weren’t answered.

Yields on Nigeria’s $500 million of bonds due July 2023 rose 2 basis points to 8.04 percent as of 1:32 p.m. in London on Monday, having climbed to a record high of 8.54 percent on Aug. 24. Rates on Kenya’s $2 billion of debt maturing in June 2024 fell 1 basis point to 7.53 percent. Nigerian dollar notes have lost 5.8 percent this quarter, compared with an average drop of 0.5 percent among 59 emerging markets tracked by Bloomberg.

Average naira-denominated government bond yields rose 7 basis points to 16 percent last week, the highest among 31 emerging markets tracked by Bloomberg.

“It’s markets are basically frozen domestically,” said Ashmore’s Dehn, who prefers Eurobonds issued by Ivory Coast and Kenya because their economies are better managed. “Monetary policy and access to the Nigerian market is being managed in a way that’s incomprehensible to investors. The Buhari administration has shown a remarkable lack of urgency. At a time of negative oil shocks, it is not confidence inspiring.”

(via Bloomberg)